Remittance Overview of Bangladesh

In Bangladesh, Remittances refers to inflows of migrants and short-term employee income transfers. Remittances from more than 10 million peoples of Bangladesh being abroad are very important for Bangladesh and along with garments exports are key source of foreign exchange. Saudi Arabia has been the largest source of remittances, followed by UAE, Qatar, Oman, Bahrain, Kuwait, Libya, Iraq, Singapore, Malaysia, the US and the UK

Bangladesh's economy relies heavily on its expatriate earnings, which is the second-biggest source of foreign currency earnings. The World Bank projected remittance flows to Bangladesh would rise in 2023 from the negative growth in 2022, and, currently, remittances are growing at 7 per cent in the country and are expected to reach USD 23 billion in 2023, according to a World Bank report. In addition, the fiscal incentives and domestic monetary supportive policies by the government and Bangladesh Bank also play a pivotal role in returning the remittance inflows to a positive trend.

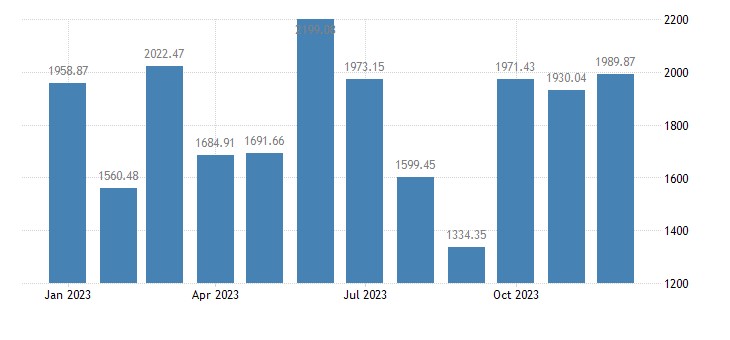

In December 2023, remittances to Bangladesh increased from 1930.04 USD million in November to 1989.87 USD million. From 2012 to 2023, remittances to Bangladesh averaged 1434.02 USD million; it peaked in July 2020 at 2598.21 USD million and dropped to a record low in September 2017 of 856.87 USD million. Source: Bangladesh Bank.

Figure: Remittance Inflow Graph of Bangladesh USD in Million. Source Bangladesh Bank

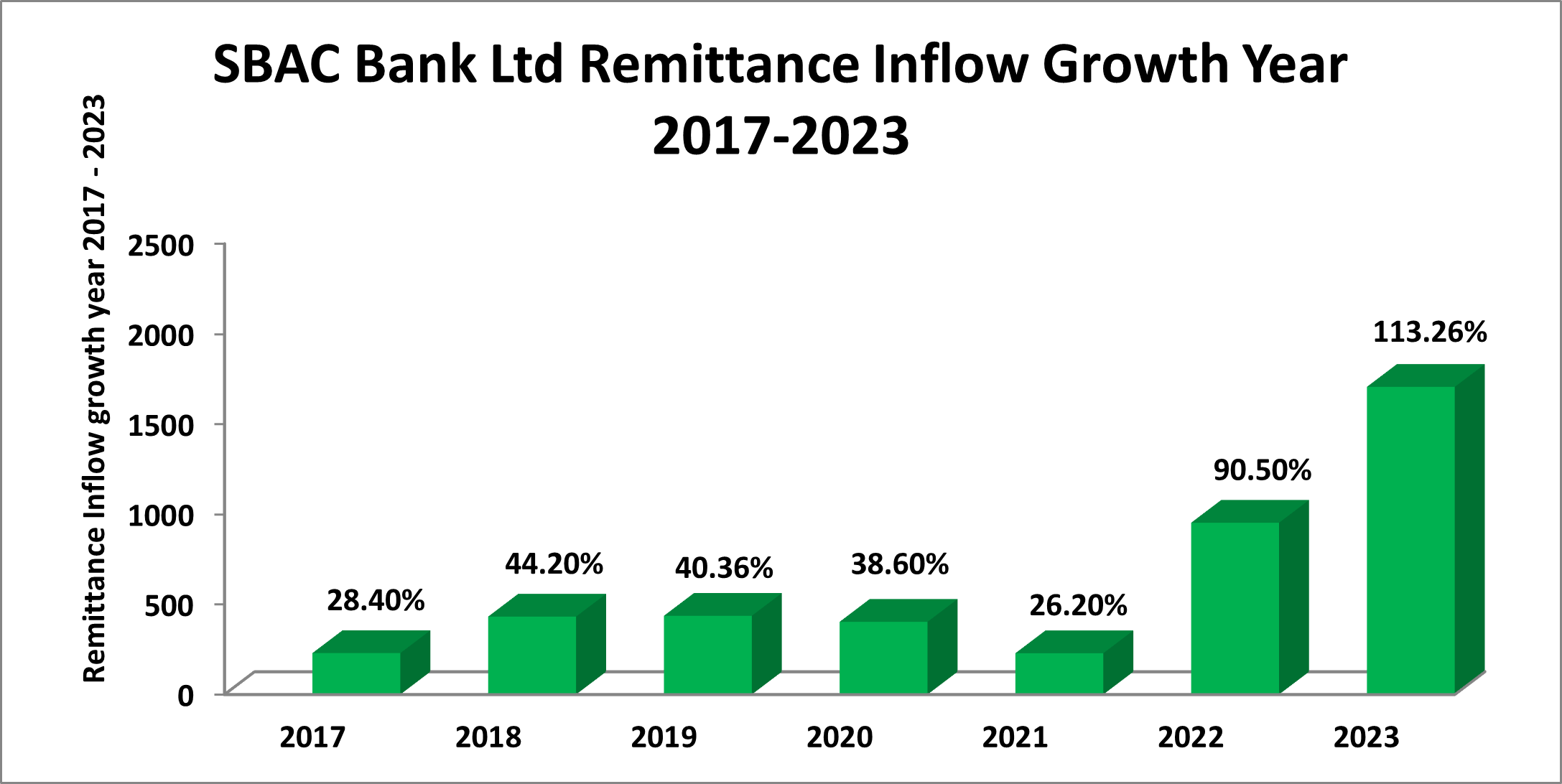

Remittance Department of SBAC Bank PLC

SBAC Bank PLC has set up a specific target for achieving remittance target by giving top most priority service to its remittance clients and performing smooth remittance transaction for all partnered money exchange companies. SBAC Bank PLC continues its effort to encourage people of Bangladesh living abroad for remitting hard earned money through legal banking channels. Remittance is one of the most important sources of foreign exchange earning in Bangladesh. SBAC bank PLC has set up arrangements with 15 reputed Exchange house/money transfer companies around the world remittance to the country.

For Inward Remittance, SBAC Bank has established extensive drawing arrangement networks with Banks and Exchange Companies located across the world. SBAC Bank PLC have Drawing Arrangements with Exchange Houses to facilitate fast, reliable, and hassle-free remittance to Bangladesh for the expatriate Bangladeshis around the world. SBAC Bank PLC also has special arrangements to credit Beneficiary’s account maintained with us on the same day through our extensive real time on-line network. For remittance thought SBAC Bank, Migrant Bangladeshis can avail services from Xpress money Services limited, MoneyGram, Western Union Network, Aman Exchange company Kuwait, NEC Money transfer UK, Wall Street Finance LLC USA, Al Ansari Exchange LLC, UAE, Worldwide West 2 East Service PLC UK; LCC transcending PLC (Small World) UK, Sunman Global Express Corp (USA), MasterCard (Prv: Transfast) Remittance LLC, Placid NK Corporation, Ria financial service, Turbo Cash and National Exchange Italy S.R.L.

Figure: Remittance Inflow of SBAC Bank PLC Year (2017-2023)